There is a compliance problem.

- Compliance with the letter-of-the-law is no longer the mark.

- Commissioner Hayne in the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry has defined the standard to which companies will now be held; the ever-evolving consumer-led standard of “fairness”.

- You need to know if your products, services and conduct are going to be deemed fair by consumers; against their expectations, not yours.

- CertFair achieves this knowledge for you.

THE NEED IS NOW

Why be fair?

OUR POINT OF VIEW

Being consciously fair leads to consciously building trust.

Opportunity emerges and consumer and regulator trust is deepened when organisations understand and bring to life their intrinsic role in building a safer and trusting society; by playing fair.

Understanding the purpose of your organisation, the societal benefit it brings to all stakeholders, and then building the mindset and systems of a purpose-led culture is the key to being the competitive consumer led “trusted” and “fair” organisation you need and want to be.

Our Purpose is to help you build trust in your insurance and financial services company.

Our Mission is to go beyond compliance to aid organisations to be “fair” in the eyes and experience of customers, regulators and the community.

Fairness is a way of being that your customers experience.

We assess fairness by identifying differences between your view of what is fair and your customers’ expectations as to fairness. It’s a “current state” reflection of your culture, products and services in the experience of your customers and in the view of the regulators.

CERTFAIR AUDITS FAIRNESS USING EXISTING COMPLIANCE SYSTEMS. IT IS A PROCESS DESIGNED THROUGH THE UNIQUE

COMBINATION OF ITS FOUNDERS’ VALUES AND PURPOSE, COMMERCIAL EXPERIENCE AND INDUSTRY WISDOM.

CertFair exploits the natural synergy between 2 experienced professionals who have come together to solve an enduring customer problem that requires immediate attention – meeting community expectations of fairness.

A deep understanding of values-led organisations through purpose, leadership and culture. Tony Bonney has 33 years experience in customer and team engagement, organisational values and ethos, leadership and purpose led culture.

A deep understanding of the financial services industry including the impacts of the Royal Commission recommendations and other regulatory change. Paul Muir has 35 years financial services experience specialising in risk and compliance, regulatory affairs, governance, risk culture and consumer advocacy.

HOW CAN CERTFAIR HELP?

MEASURE CURRENT STATE

We provide a point-in-time view of an organisation’s inherent fairness, identifying areas where attention is required.

EDUCATE ON BENCHMARKS

To become the organisation you aspire to be. The desired future state.

We compare where you are to where you want to be.

We provide you with external objective data with which to measure fairness against.

PROVIDE A ROADMAP TO BEING FAIR

We show you the major steps to shift the focus from Compliance Process to Customer Fairness.

We provide niche services tailored to your specific needs rather than a ‘’one size fits all approach’’

Using your existing risk & compliance framework we enable you to keep pace with ever moving community expectations.

CERTIFY THE MEASURE OF FAIRNESS

Following a CertFair audit and the closure of identified gaps, CertFair will certify for 12 months that your processes are aligned with the standard of ‘fairness’ as viewed and publicly stated by ASIC and AFCA.

READ MORE IN OUR BLOG SECTION

Today is a very special day for CertFair as we launch our new website

For some time we have been passionately exploring how [...]

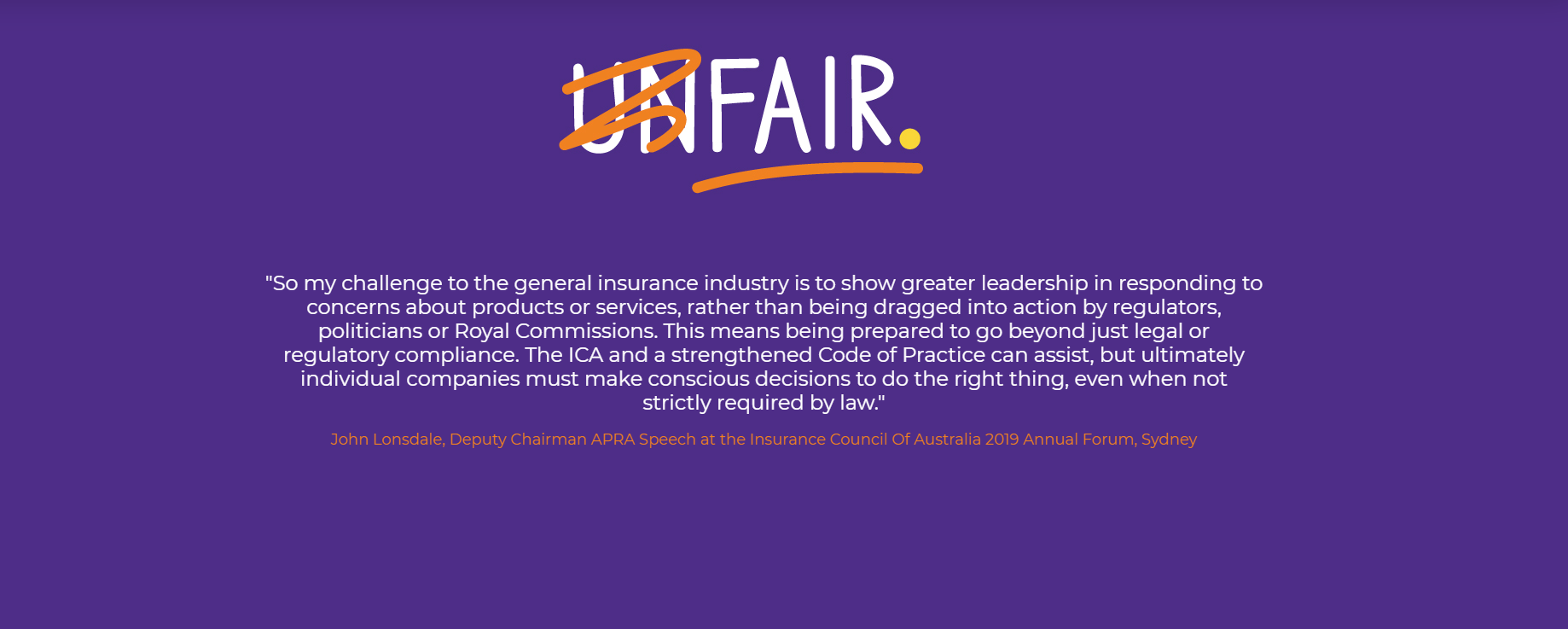

Powerful speech by John Lonsdale, Deputy Chairman APRA to Insurance Council Of Australia 2019 Annual Forum, Sydney

Mr Lonsdale clearly articulated the difference between compliance with [...]

AFCA’s response to the Royal Commission Final Report

In its response to the Royal Commission recommendations AFCA [...]